food tax in maine

It is written in a relatively informal style and is intended to. From property tax under section 652 subsection 1.

Sales Tax On Grocery Items Taxjar

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Maine Meals Tax Restaurant Tax.

. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Maine FoodBeverage Tax. To learn more see a full list of taxable and tax-exempt items in Maine. This state has special 8 sales tax rates for lodging including hotels and motels and prepared food as well as a 10 tax on short-term vehicle rentals.

A 6 percent tax was levied on dozens of foods including crackers cookies pretzels muffins frozen yogurt and ice cream. 9 rows Prepared Food. Businesses making retail sales in Maine collect sales tax from their customers on tangible personal property items and some services.

While Maines sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. John McKernan needed money to get the state out of a budget crisis. About the Maine Sales Tax.

The tax on short-term car rentals is 10 percent. Pet food assistance organization. Maines snack tax was enacted in 1991 when lawmakers and then-Gov.

Food Beverage Sales Tax Guide. Maine food stamps are available throughout the state to low-income families who are struggling financially. John McKernan needed money to get the state out of a budget crisis.

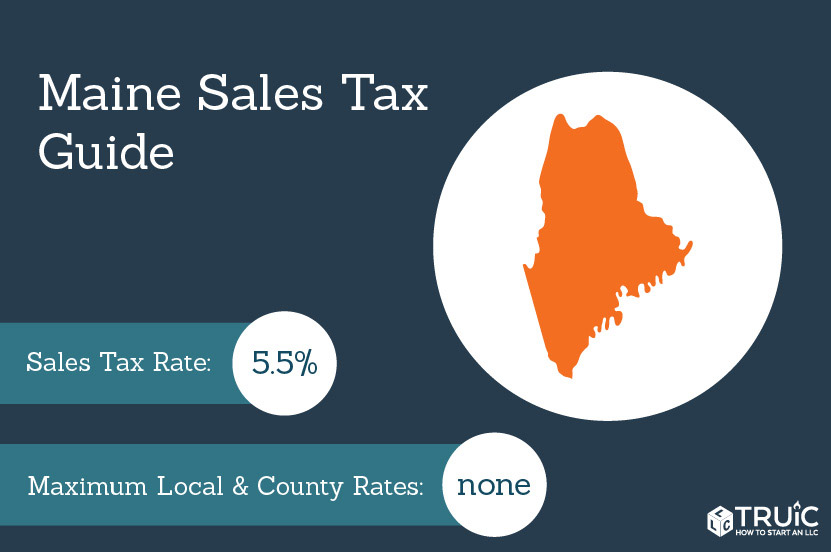

12 RETAILERS OF FOOD PRODUCTS This bulletin is intended solely as advice to assist persons in determining and complying with their obligations under Maine tax law. Maines general sales tax rate is 55 percent. Maine has no special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

27 SALES OF PREPARED FOOD This bulletin is intended solely as advice to assist persons in determining and complying with their obligations under Maine tax law. It is written in a relatively informal style and is. A Maine Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Retail sales tax is the state of Maines principal tax source. These percentages are all officially sales taxes. Business Equipment Tax Exemption BETE.

Sales to an incorporated nonprofit organization organized for the purpose of providing food or other supplies intended for pets at no charge to owners of those pets. Long Term Auto Rental. To tax or not to tax.

While officially referred to as the Supplemental Nutrition Assistance Program SNAP this initiative provides qualifying petitioners with a way to purchase groceries each month. Maines snack tax was enacted in 1991 when lawmakers and then-Gov. The state of Maine has a simple sales tax system and utilizes a flat state tax rate that was last raised in 2007.

Starting Friday Mainers will be required to pay state sales tax on hundreds of food and beverage products that previously were tax-exempt including fruit gummies chocolate chips. This page describes the taxability of food and meals in Maine including catering and grocery food. A Maine FoodBeverage Tax can only be obtained through an authorized government agency.

You can read Maines guide to sales tax on prepared food here. In the state of Maine legally sales tax is required to be collected from tangible physical products being sold to a consumer. Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns.

Counties and cities are not allowed to collect local sales taxes. MAINE REVENUE SERVICES SALES FUEL SPECIAL TAX DIVISION INSTRUCTIONAL BULLETIN NO. Maine Prepared foods are taxable in Maine at the prepared food tax rate of 8.

Food and supplies essential to the care and maintenance of seeing-eye dogs used to assist blind people are exempt from sales tax. Copies of sales receipts should be kept to support the exemption. Sales to a nonprofit community-based.

A 6 percent tax. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55. A 6 percent tax was levied on dozens.

MAINE REVENUE SERVICES SALES FUEL SPECIAL TAX DIVISION INSTRUCTIONAL BULLETIN NO. The state also levies charges of 8 percent on prepared food lodging and liquor. Groceries and prescription drugs are exempt from the Maine sales tax.

Nonprofit worldwide charitable organizations. Maine grocers have enough in. Maines snack tax was enacted in 1991 when lawmakers and then-Gov.

IncomeEstate Tax Guidance Documents. Several examples of exceptions to this tax are most grocery products certain types of prescription medication some medical equipment and certain items associated with commerce. What foods are exempt from sales tax in Maine.

Maine Sales Tax Small Business Guide Truic

In Chicago Candy That Is Prepared Without Flour Is Taxed As Candy At 6 25 Candy Prepared With Flour Is Taxed At 1 As Food Bizarre Tax Social Change

Soft Water Food Ads Vintage Recipes Retro Recipes

Green Leaves Restaurant Lounge Meadowbrook Village Plaza 647 U S Route 1 Unit 3 Y Leaf Restaurant Sweet Sour Chicken Shrimp With Lobster Sauce

Colorado Collects A Sales Tax On Straws And Cup Lids Because The State Considers Them Nonessential Food Items Bizarre Tax Social Change

Pin On Food Images For Maine Clambake Mysteries

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Warren S Lobster House Lobster House Maine Lobster Kittery

Is Food Taxable In Maine Taxjar

Is Food Taxable In Maine Taxjar

Spondi Best Places To Eat Gourmand Gastronomy

Maine Photographer Maine State Sales Tax Collection Sales Tax Tax Tax Guide

Pin By Miles On Personal Brand In 2021 Rose Recipes Best Bagels Beautiful Branding

The Real Cost Of Pink Tax Pink Tax What Is Pink Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Https Images Squarespace Cdn Com Content V1 5abb2ddfcc8fed75da600ac0 1535306170210 Qwqedp1z1bo8h5r3f0x8 Ke17zwdgbtoddi8pdm48klkxf2piy Rose Recipes Maine Rose